If condition is acceptable, I think this is a good deal:

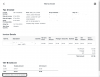

Intel Optane SSD DC P-4800X 750GB SSDPED1K750GA | eBay

Upgrade your computer's storage capabilities with this high-performance Intel Optane SSD DC P-4800X. With a storage capacity of 750GB, this internal SSD provides ample space for all your important files and documents. The PCI Express interface ensures fast data transfer speeds, making it perfect...

www.ebay.co.uk